PAINTING NEW INVESTMENTS

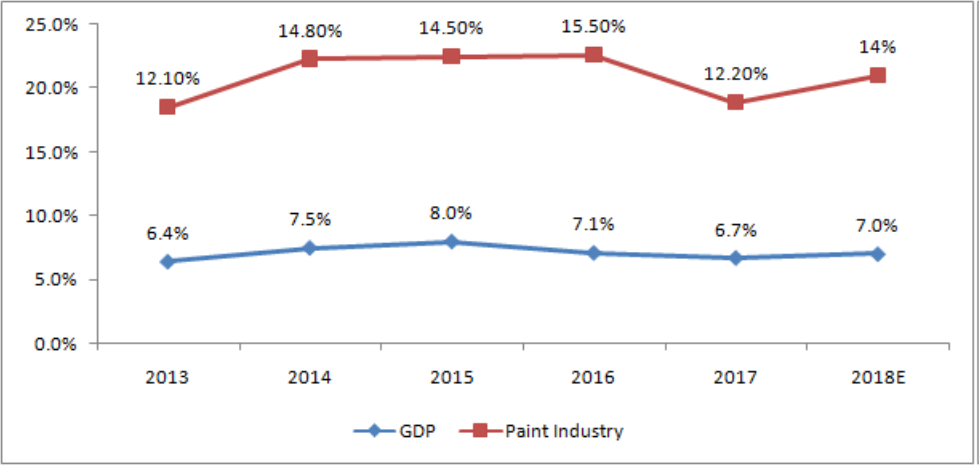

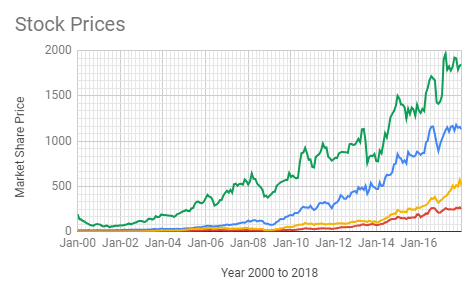

Posted on September 11, 2018The paint industry has always been one that has outperformed the market indices year after year. While the SENSEX & NIFTY have grown at around 690% & 744% over the last 18 years, the paint industry has grown up to 10,000% giving investors a great deal of optimism for the sector. Akzo Nobel has grown by 748%, Asian Paints, 7,144%, Berger 10,733%, and Kansai Nerolac 12,299% in this same period. The Paint industry growth rate has been between 1.5 to 2 times of GDP growth rate.

Much of this has been fuelled by growth of housing, retail & office spaces, and infrastructure. The paint industry has now reached a point where most players have nearly exhausted their current capacity and are set to make massive investments in new manufacturing capacity. The mood and ambition reflect the ability and preparedness of the industry take on the growth challenges that lie ahead as they undertake the most ambitious capex cycle in Indian economic history.

Market Share, & Growing Demand: The domestic paint industry is estimated at Rs. ~47000 crore as of Mar 2018 and is expected to grow at a CAGR of around 12-13% during 2017-18 to 2021-22. The industry today is a largely organised one with about 65-70% of the market belonging to organised players, and the rest with small unorganised units. Since the mid-nineties the paint industry has been gradually moving towards being more organised in nature. The unorganised sector controls around 30% of the paint market. In the unorganised segment, there are about 2,000 units having small and medium sized paint manufacturing plants. In the organised sector a good 75-80% of the market share lies with 4 major players – Asian Paints, Kansai Nerolac, Berger Paints, and Akzo Nobel India. The market size of the decorative paint segment was in the region of Rs. 30,385 crore, while the industrial paint segment stood at Rs. 9,915 crore in FY14-15. Given the rapid growth, the overall size of the market is expected to touch Rs. 70,875 crore in the coming financial year according to Indian Paint Association. Significant investments in infrastructure by the government, coupled with several steps to promote affordable housing have fuelled a significantly higher demand for paint in the recent decade. Paint industry is classified into two broad categories viz., Decorative and Industrial. While decorative paints constitute 75% share of the market sales, industrial paints constitute 25% of the market share. And with both foreign and domestic auto makers eyeing double digit growth in India, the automotive industry is contributing a large portion of growth to the paint industry too. This has many analysts pegging the industrial paint segment to grow around 12.5% while the decorative segment will see higher growth at around 13.5% CAGR backed by new demand from tier II and tier III cities. Much of the demand for decorative paints is seen during the festive season. The decorative segment is also expected to improve because of shortening of the repainting cycle and a good monsoon. While the double whammy of GST and demonetisation hit real estate related industries in general, the paint industry has recovered to some extent and is set to make more gains thanks to the reduction of GST rates for the industry in the recent months to 18% from 28%. The industry on the whole has been taking steps to grow demand. Skill training, automation and digital marketing are helping create premium segments in the decorative paints market. Consumer tastes are helping in this regard. The evolving tastes of the middle class Indian have moved paint up the value chain. These higher value segments allow the industry to maintain healthy margins. The industry has been witnessing a gradual shift in the preferences of people from the traditional whitewash to higher quality paints like emulsions and enamel paints, which is providing the basic stability for growth of Indian paint industry. The per capita paint consumption in India which is a little over 3.5 kgs is still very low as compared to the developed western nations. Therefore, as the country develops and modernises, the per capita paint consumption is bound to increase. The 4 major players have also managed to segment the industry into finer units and sustain demand. Paint is now available in multiple formats from ready to use paints to pre-mixes, and 30-50ml to 20 litre units. This all has the Indian Paint Association expecting a 10-15% growth in sales this financial year.

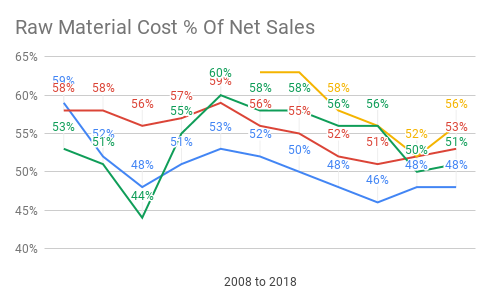

Pricey Raw Materials & Margin Protection: The industry is now moving towards water based paints in an effort to protect themselves from the high cost of materials associated with oil based paints. The lower costs associated with water based paints is helping companies improve penetration in lucrative new markets while protecting their margins. The decorative paint segment is especially price sensitive and a higher margin business as well. But the paint industry is a raw material intensive industry and raw material prices have been growing. 30% of the 300 odd raw materials required are petro-based, and the industry can benefit slightly from lower crude oil prices. 2017 saw margins hit quite a bit due to the increasing oil prices. The premiumisation trend among major players is helping them all protect their margins and upsell paint at a constant pace. But it’s not just crude that is hurting margins, titanium dioxide, iron oxide, and zinc oxide prices have also been high in the recent past. In the midst of the raising raw material prices, major players have been able to take advantage of their brand equity and stave off the rising raw material prices. So while we can see a steady improvement in the profitability related to raw materials cost over the years, the recent surge in crude oil prices has definitely hurt margins.

Manufacturing Capacity & Expansion: Most of the big players are set to add additional capacity to their operation to aid in meeting the growing demand. This is set to be the biggest addition of capital expenditure seen in the industry ever. Among the big 4 of the Indian paint industry, Asian Paints, the leader in the decorative paints segment, operates over 30 manufacturing facilities both in the country and in foreign markets. It’s set to add two new facilities in Andhra Pradesh and Karnataka at a cost of around Rs. 4000 crores. The plants are set to be operational in this financial year.

Kansai Nerolac, the leader in the industrial paints segment, has 4 plants in the country. Nerolac is set to add production capacity which will aid in improving volumes. It is set to add 3 new manufacturing facilities in Gujarat, Punjab, and Andhra Pradesh. This will come at a cost of around Rs. 216.5 crore. Akzo Nobel, the owner of brands such as Dulux and Sikkens, operates 6 plants across India. In addition to its acquisitions in 2016, the company commenced another plant in Mumbai to cater to the demand from western and northern India. This came at a cost of around Rs. 72 crore.

Berger Paints India currently has 10 manufacturing units in India. It is set to build a new plan in Uttar Pradesh for a cost of around Rs. 150 crores. This will enable it to maintain profitability and bring on new technology. It has also made upgrades to plants in Maharashtra.

Asian Paints & Kansai Nerolac are both increasing their water-based paint production capacity amidst increasing demand for more affordable water-based paints, and the lessened impact on the environment due to the same.

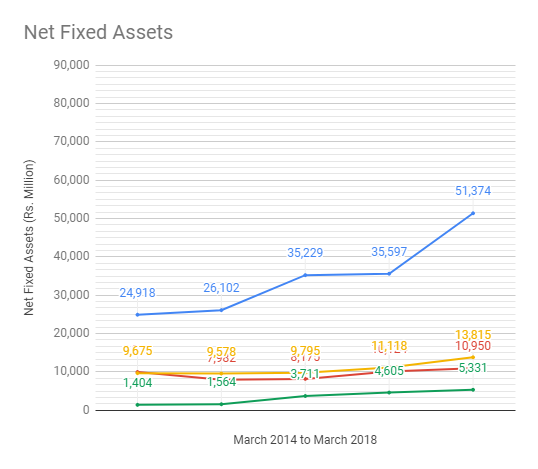

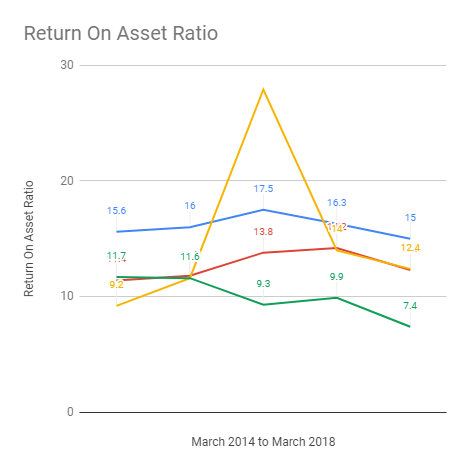

Financing The Added Capacity: With the entire industry set to add additional capacity it could spell trouble for the industry. While Asian Paint has been rapidly adding assets, the other players have maintained a more steady approach. But the declining returns on assets suggests that profitability will be hit in the near term as the industry tries to cope with increasing raw material prices as well as investing in new capacity.

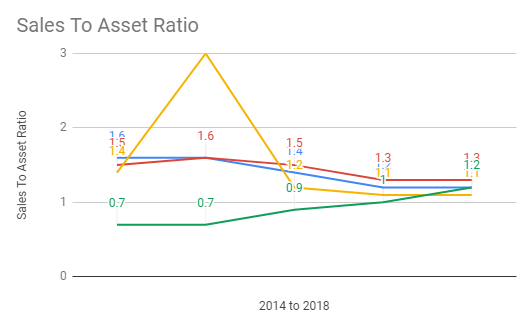

On the sales to asset ratio, Akzo Nobel is the only of the big 4 to be on an upward trend. The other players have a largely stable sales to asset ratio.

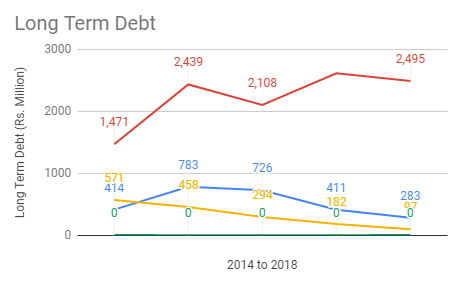

With the exception of Berger Paints, the big players are also reducing their debt significantly, and are by default cash rich companies with low percentages of debt financing.

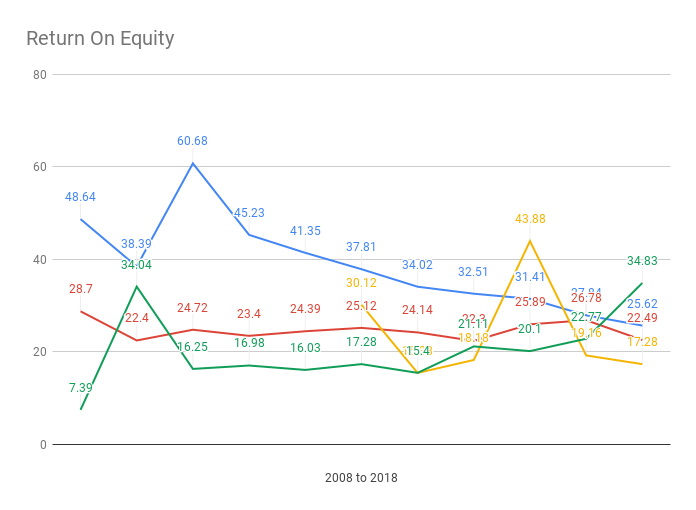

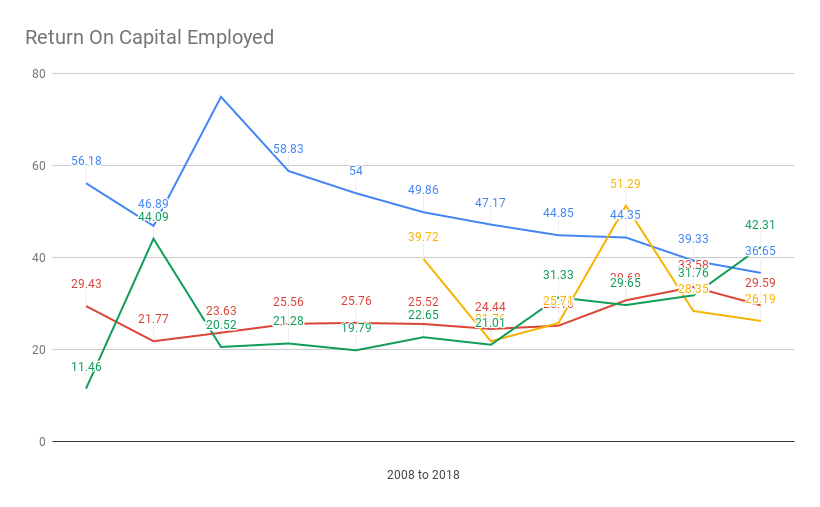

As companies with a low volume of debt we can also take a look at the ROE & ROCE. Asian Paints has seen a steady but slight decline in ROE, while Akzo has showed improvements in its ROE over time. Berger Paints has a steady performance, while Nerolac’s profitability has been affected by its recent investments.

All of this bodes well for the biggest players. Akzo Nobel might well turn out to be a surprisingly good investment as long as it can find the sales. Berger Paints might suffer from the capex cycle and go through some rough months, but should find a way to maintain profitability. Asian Paints and Kansai Nerolac are in the best position to take advantage of the increasing demand for paint in India. Their already dominant positions and brand equity will help keep the revenue growing and be in the green zone even as they make big investments in capacity. Reduced profitability in the near future will quickly be overshadowed as long as the demand keeps up as expected.

A Pretty Picture: Asian Paints remains a favourite due to its standing in the decorative paints market and can sustain competitive prices & margins even as the whole industry increases supply in a price sensitive market. On the other hand Kansai Nerolac has a strong position in the industrial paints segment and is in a good position to maintain margins even as the industry supply increases and new capacity is installed. Both are likely to go through a short period of reduced profitability as new investments are made, but will ultimately recover. The price of raw materials could hurt margins a bit, but the strong and expanding demand in the market is likely to help the bigger players push through.